Life Insurance in and around Atlanta

State Farm can help insure you and your loved ones

What are you waiting for?

Would you like to create a personalized life quote?

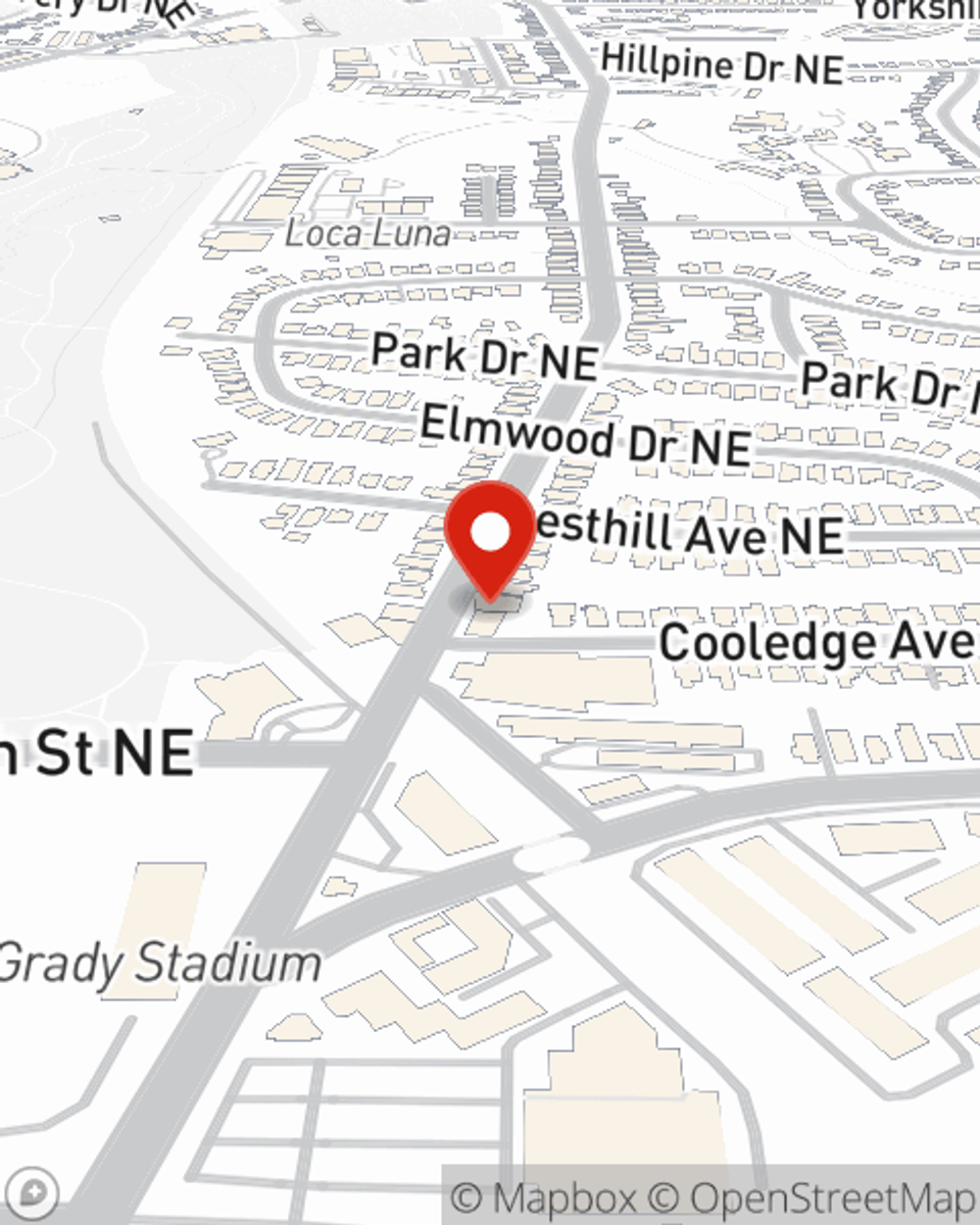

- Atlanta, GA

- Old 4th Ward

- Kirkwood

- Inman Park

- Decatur

- Brookhaven

- Virginia Highlands

- Atlanta

- Midtown

- College Park

- East Lake

- Georgia

Your Life Insurance Search Is Over

Taking care of those you love is an honor and a joy. You listen to their concerns help them make decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

State Farm can help insure you and your loved ones

What are you waiting for?

Put Those Worries To Rest

You’ll get that and more with State Farm life insurance. State Farm has terrific policy choices to keep those you love safe with a policy that’s adjusted to match your specific needs. Thankfully you won’t have to figure that out on your own. With personal attention and excellent customer service, State Farm Agent Angie Sue Brown walks you through every step to create a policy that protects your loved ones and everything you’ve planned for them.

Interested in finding out what State Farm can do for you? Reach out to agent Angie Sue Brown today to get to know your specific Life insurance options.

Have More Questions About Life Insurance?

Call Angie Sue at (678) 732-9588 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Angie Sue Brown

State Farm® Insurance AgentSimple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.